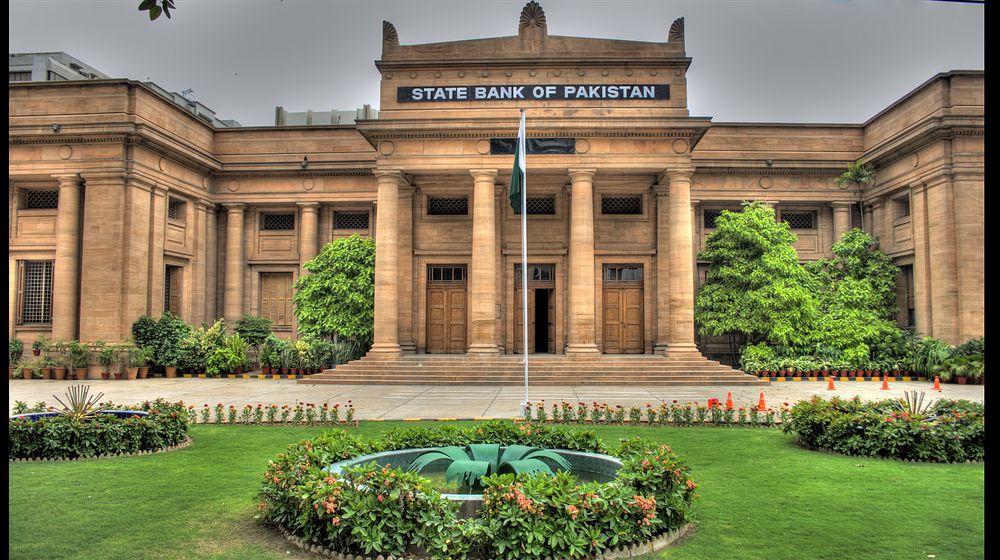

The State Bank of Pakistan (SBP) declared its every other month money related approach on Friday and chose to keep up its arrangement rate at 7%, as per an assertion gave by the bank.

"Monetary Policy Committee of State Bank of Pakistan kept up strategy rate at 7pc," the national bank said in an explanation, adding that the current position of the money related arrangement was proper to help monetary recuperation, keep up monetary strength and keep swelling assumptions "very much secured".

The MPC anticipates that monetary policy settings should remain "extensively unaltered" in the close to term, the assertion added, underlining that any change in the strategy rate would be estimated and steady to accomplish "somewhat certain genuine loan fees" as recuperation turned out to be stronger and the economy got back to full limit.

Late swelling out-turns have been unpredictable, with the least perusing on feature expansion in over two years in January 2021 followed by a sharp ascent in February. As per SBP gauges, the new expansion in power duties and sugar and wheat costs represents about 1½ rate points of the 3 rate point expansion in swelling between the January and February out-turns. The new expansion in power costs will keep on showing in feature numbers in coming months, keeping normal swelling in FY21 near the upper finish of the recently reported scope of 7-9 percent

The Monetary Policy Committee additionally observed the vulnerability around the swelling and development standpoint. On the development front, the MPC noticed that regardless of late energy, chances stay because of the rise of a third, more destructive influx of Corona-virus in Pakistan similarly as the antibody carry out is starting.

The MPC thought about key patterns and prospects in the genuine, outer and financial areas, and the subsequent viewpoint for money related conditions and swelling.

For more news and blogs, keep connected and updated with www.SabzProperty.com